when will capital gains tax increase take effect

In this case it might be worth it to elect out of. Current law The top tax rate is 20.

Major Capital Gains Tax Increases Could Kill The Property Market Property Industry Eye

How the increase in capital gains taxes can affect your clients business.

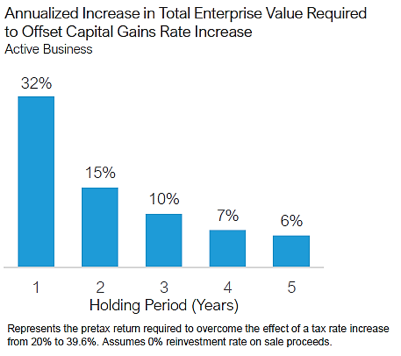

. When will capital gains tax increase take effect Tuesday May 24 2022 Edit This will affect long-term and short-term capital gains since both would be taxed as ordinary. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. Should Bidens new capital gains provisions take effect in 2022 your total tax would be increased by over 300000.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Tax changes that could affect investments Tax rate on long-term capital gains and qualified dividends. The recent change in presidency is set to bring about substantial changes in the way high-net worth individuals are.

Its estimated that the tax will bring in over 400 million in its first year. By Michelle Seiler Tucker July 07 2021 1038 am. Long-Term Capital Gains Taxes.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. Bidens budget assumes the BBBA increases take effect and would pile on another 25 trillion of tax increases 16 trillion from corporate and international tax. The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate.

The recent change in. But because the higher tax rate as. PWBM estimates that raising the top statutory rate on capital gains to 396 percent would decrease revenue by 33 billion over fiscal years 2022-2031.

However the real gain after adjusting for the doubling of the. In 2022 it applies to long-term capital gains. Originally posted on Accounting Today on July 7th 2021.

EDT 5 Min Read. The top rate would jump to 396 from 20. If a capital gains increase is prospective taking.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Taxpayers may time gains for a year when they have losses to offset gains or when they have income levels below the 1 million threshold. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

While it technically takes effect at the start of 2022 it wont officially be collected until 2023.

Strategies To Deal With Potential Capital Gains Tax Increases Kiplinger

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How Will Capital Gains Tax Increases In 2022 Impact M A This Year The Journal Record

Case Study 3 Reduced Tax Rates On Capital Gains And Qualified Dividends Tax Foundation

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Capital Gains Tax Low Incomes Tax Reform Group

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

How Does Biden S Long Term Capital Gains Tax Proposal Work R Ask Politics

Ingenium Capital Private Limited On Twitter Shares Invested For Less Than 270 Days To Attract 40 Capital Gains Tax In New Government Measures To Curtail Speculative Activities On The Stock Market Https T Co Daef3kn8ho

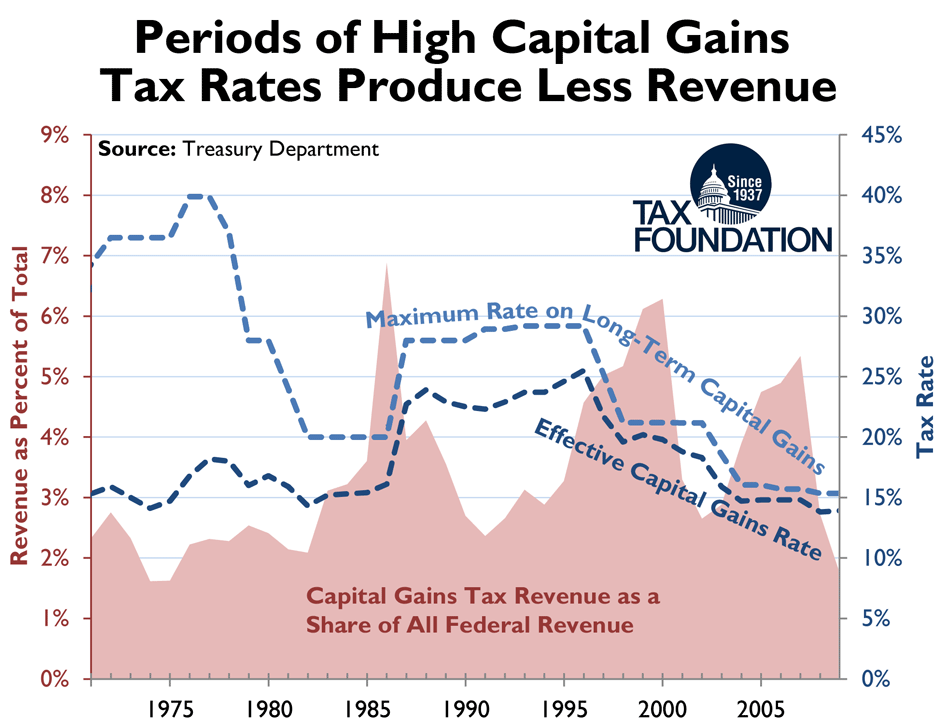

Chart Periods Of High Capital Gains Tax Rates Produce Less Revenue Tax Foundation

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

How Are Capital Gains Taxed Tax Policy Center

How Does The Capital Gains Tax Work By Kevin Martini

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Economic And Revenue Effects Of Permanent And Temporary Capital Gains Tax Cuts Unt Digital Library

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool